What Makes a Good Rental Property in Edmonton? A Local Property Manager’s Checklist

Source: britannica.com

In the Edmonton real estate market of 2026, the gap between a "profitable asset" and a "money pit" has never been wider. With a record supply of new units hitting the market and shifting federal mortgage rules, investors can no longer rely on general market appreciation alone. Success now requires a clinical, data-driven approach to property selection.

At Power Properties, we’ve managed thousands of doors in Alberta. We know that the "perfect" property isn't just about a low purchase price; it’s about a specific combination of location, lifestyle amenities, and financial resilience.

Whether you are looking for rental property management in Edmonton for an existing portfolio or are planning your first purchase, this is the checklist our professional managers use to evaluate a winning rental property.

1. The Location & Demographic Fit

In 2026, Edmonton's rental market is highly segmented. A property that appeals to a student near the University of Alberta will fail miserably if marketed to a young family in Windermere.

The Proximity "Power Three"

A top-tier rental property must be within a 15-minute radius (walk or transit) of at least two of these three anchors:

Major Employment Hubs: The Downtown Core, the Misericordia or Royal Alexandra Hospitals, or industrial zones like Nisku/Leduc.

Post-Secondary Institutions: U of A, MacEwan, or NAIT.

Lifestyle Clusters: Walkable districts like 124th Street, Whyte Ave, or the Brewery District.

The "Commuter Corridor" Test

Edmonton is a driving city, but the Valley Line West LRT and the Anthony Henday Drive define desirability. Properties with "easy-off, easy-on" access to the Henday or within 800 metres of an LRT station see 12-15% lower vacancy rates on average.

2. Property Features: The 2026 "Must-Have" List

Tenant expectations have evolved. Features that were considered "luxury" five years ago are now "standard" for the most reliable, high-income tenants.

| Feature | Why It Matters in 2026 | Manager’s Advice |

|---|---|---|

| In-Suite Laundry | The #1 requested amenity among renters, especially professionals and dual-income households. | Never buy a rental without it. Shared laundromats are a dealbreaker for modern professionals and significantly limit your tenant pool. |

| Climate Control (A/C) | Alberta summers are hitting record highs, shifting tenant expectations permanently. | Properties with central A/C or heat pumps consistently command a $100–$150/month rent premium and lease faster. |

| Dedicated Work Space | Hybrid and remote work are now the default, not a perk. | Even a small “tech nook” or a bedroom large enough for a desk can increase perceived value and demand by up to 40%. |

| Smart Security | Urban renters prioritize safety, convenience, and digital access control. | Install smart locks and doorbell cameras. They attract tech-savvy tenants, reduce disputes, and can even lower insurance costs. |

3. The Maintenance & Durability Audit

Property rental management success is found in the margins. If your maintenance costs exceed 15% of your gross rent, your investment is in trouble. When walking through a potential property, we look for "maintenance-resistant" features:

Luxury Vinyl Plank (LVP) Flooring: Say no to carpet. LVP is waterproof, scratch-resistant, and can last through multiple tenancies without replacement.

High-Efficiency HVAC: With carbon taxes and rising utility costs, properties with high-efficiency furnaces and triple-pane windows are easier to rent "utilities included" or easier for tenants to afford if they pay their own.

The "Age of Systems" Check: Always verify the remaining life of the roof, the hot water tank (usually 10-12 years), and the furnace. A $10,000 furnace replacement in year two can wipe out three years of profit.

Read also: Renting Your First Home in Edmonton? Read This First

4. Financial Performance Metrics: Beyond the "Rule of Thumb"

Experienced investors don't just look at the monthly rent; they look at the financial yield metrics. If you are wondering what a rental property management company does, one of our primary roles is "Stress Testing" your property's financials.

Key Metrics to Track:

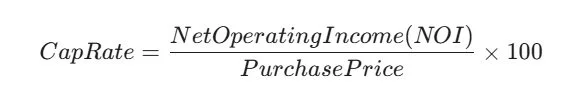

Cap Rate (Capitalization Rate):

In 2026 Edmonton, we typically look for a Cap Rate between 5.5% and 7% depending on the neighbourhood.

Cash-on-Cash Return:

This measures the annual pre-tax cash flow divided by the total cash invested (down payment + closing costs). In a high-interest-rate environment, this is the most honest metric of your "out-of-pocket" performance.Operating Expense Ratio (OER):

Total operating expenses divided by gross income. A "good" rental property in Edmonton usually has an OER of 35-45%. If it's higher, the property may be inefficient or the rent is too low.

Why Use a Property Manager Checklist?

Self-managing a single condo might seem easy, but as your portfolio grows, the complexity scales exponentially. A property manager checklist ensures that no detail, from smoke detector expiry dates to the 2026 OSFI mortgage compliance rules, is missed.

What Does a Rental Property Management Company Do for You?

Market Pricing: Using real-time data to ensure you aren't leaving money on the table.

Vetting: Utilizing AI-driven screening to find tenants who will treat your property like their own.

Legal Compliance: Navigating the Alberta Residential Tenancies Act and the new 2026 municipal bylaws.

24/7 Response: Handling the "furnace out" call at 2:00 AM on a -30°C January night.

The Ultimate Edmonton Investor's Checklist (Quick Reference)

Phase 1: The "Hard" Assets

[ ] Is the roof under 15 years old?

[ ] Are the windows double or triple-paned?

[ ] Is there in-suite laundry?

[ ] Is the flooring LVP or tile (no carpet)?

Phase 2: The Location

[ ] Within 10 mins of a major transit hub?

[ ] Walk Score of 70+ (for urban) or near a major school (for suburban)?

[ ] Is the neighbourhood seeing "Infill" activity?

Phase 3: The Financials

[ ] Does it meet the 6% Cap Rate target?

[ ] Is there a "Value-Add" opportunity (e.g., adding a basement suite)?

[ ] Are condo fees (if applicable) stable and inclusive of a healthy reserve fund?

Take the Guesswork Out of Your Next Investment

Finding the best rental properties in Edmonton is a science, not a hobby. At Power Properties, we help investors identify, acquire, and manage high-performing assets that stand the test of time.

Would you like us to run a "Rentability Audit" on a property you are currently considering? Contact our team today for a professional assessment before you sign on the dotted line.

About Power Properties Ltd.

Founded in 1980, Power Properties has been providing hassle-free property management services to property owners, property investors and non-residents with homes in Calgary, Edmonton, Lethbridge and Medicine Hat for over 45 years. Our full-service property management includes everything from move in to move out, so you don’t have to worry about the day-to-day operations of your rental property. With a team of licensed professionals, years of experience, and award-winning service, you can rest assured that your property is in good hands.